2023 03/25

Fixed Rate and Floating Interest Rate in Japan: Which One Is Better for Foreigners?

In Japan, it is common to borrow money to get a mortgage loan to cover any shortfall in your funds when purchasing real estate. With the increase in the number of foreign residents in Japan, the types of mortgage loans available to foreigners are increasing.

For foreigners who consider purchasing real estate, one of the most difficult decisions to make is whether a fixed interest rate loan or a floating interest rate loan is better for you.

Fixed and floating interest rates have their pros and cons. Understanding this is an effective way to avoid regretting your choice.

This article will explain the difference between fixed and floating interest rates. In addition, it suggests which one is better to choose for foreigners.

1. Mortgage Repayment Methods in Japan

The monthly repayment amount consists of the principal divided equally by the number of repayments and the monthly interest corresponding to the principal amount.

There are two types of mortgage loan repayment methods in Japan:

★ Equal Repayment of Principal and Interest

★ Equal Repayment of Principal

If you are thinking of taking a mortgage loan, you can choose which one you prefer.

*Please note that mortgage loan repayment methods might not be optional depending on the banks.

1-1 Equal Repayment of Principal and Interest

This is a type of repayment method in which the amount of repayment paid each month is fixed. Compared to the “Equal Repayment of Principal” method, the amount of payment at the point of starting repayment tends to be smaller. However, for the same loan term, the total repayment amount will be higher than the “Equal Repayment of Principal” method. Because the amount you will need to pay with the “Equal repayment of Principal and Interest” method at the beginning is smaller, the reduction of the mortgage balance is slower than with the “Equal Repayment of Principal” method. This means that the total repayment amount becomes higher.

1-2 Equal Repayment of Principal

This is a repayment method in which the principal is divided equally over the repayment period and then interest is calculated based on the balance.

In this method, as you repay the loan, the amount of interest decreases because the monthly repayment amount decreases each time.

However, regarding the “Equal Repayment of Principal” method, the amount of repayment at the beginning is going to be higher than the repayment of the “Equal repayment of Principal and Interest” method, therefore, a certain amount of income is required when borrowing. If your income is not reaching a certain level, the maximum loan amount may be reduced.

2. Characteristics of Fixed and Floating Interest Rates in Japan

With a Japanese mortgage, the interest rate can be either a fixed interest rate or a floating interest rate.

2-1 What Is A Fixed Interest Rate?

Fixed interest rates mean that the amount of interest rate is the same during the repayment period. In Japan, there are 2 types of fixed rates:

◉ A full term fixed-rate mortgage (a type of mortgage where there is the same interest rate during the borrowing period)

◉ An initial fixed-rate mortgage (a type of mortgage where there is the same interest for the duration of your deal).

For an initial fixed-rate mortgage, you can choose the duration of the fixed rate, like 3 years, 5 years, 10 years, and so on. Generally, the longer the fixed term, the higher the applicable interest rate (an actual interest rate that is reduced from the base interest by the preferential interest rate). You can choose either a fixed rate or a floating interest rate after the duration of the initial fixed-rate mortgage.

In a comparison of repayment amounts between equal repayment of principal and interest and equal repayment of principal in a fixed interest rate, you can see that they are different.

2-2 What Is A Floating Interest Rate?

A floating interest rate is a type of interest rate that is reviewed and changes periodically. The timing of the review is different in different banks, however, in general, it is in April and October.

If a floating interest rate is increased, most banks take these measures as follows:

◉ The 5-year rule: the monthly repayment amount will be fixed for 5 years (and changed every 5 years thereafter).

◉ The 125% rule: even if the amount is revised in the sixth year, the increase must be within +25%.

3. Pros and Cons of Fixed and Floating Interest Rates in Japan

3-1 Pros and Cons of Fixed Interest Rates

Pros:

✔ Since the amount of principal and interest is fixed, you easily can make a repayment plan. For example, the necessary funds can be set aside from your monthly income for events that require a large sum of money, such as children's college education, marriage, or preparation for retirement.

✔ An initial fixed-rate mortgage has a large discount range for the interest rate. For example, if you are borrowing a Housing loan of 50 million Yen or more (as of Mar.2023), the interest rate of SMBC Trust Bank PRESTIA’s 10-year fixed-rate mortgage is 1.24% p.a., while its 5-year fixed-rate mortgage is 1.01~1.86% p.a.

Cons:

✘ In principle, it is not possible to change the duration of a fixed rate after you deal. If you want to do this, it means you will have to refinance. Hence you will have to apply to a bank again for it and pay the cost.

✘ If the applicable interest rate increases after the duration of the fixed rate, the amount of repayment will be boosted due to increasing interest.

3-2 Pros and Cons of Floating Interest Rates

Pros:

✔ In general, floating interest rates are lower than other types of interest. Additionally, as a result of an interest rate dropping down or becoming flat, the total amount of repayment may be lower.

✔ Due to a method of monetary easing, there is no immediate impact on the repayment amount in the case of a rising interest rate.

Cons:

✘ The total amount of repayment may significantly change due to the interest rate fluctuations, and the repayment amount and period may deviate from the original plan.

✘ If interest rates continue to rise, there is a risk of increasing accrued interest. In this situation, the rest of the mortgage is going to rise. If the repayment period ends before paying off a mortgage, you have to pay the balance at once.

4. Which Interest Rate Is More Popular in Japan?

It is difficult for everyone to predict an interest rate in the future, even financial professionals. Especially when a repayment period of a mortgage is long, so it is possible to see interest rates rise during this time. Choosing an interest rate is an issue for both foreign and Japanese people who want to take a mortgage. So which loan should people choose?

According to the "Survey of Private Mortgage Loan Users (April 2022)" conducted by the Japan Housing Finance Agency, 73.9% of all respondents chose floating interest rates. While 17.3% chose the fixed term option (fixed 2-year, 3-year, 5-year, etc.). The remaining 8.9% chose fixed interest rates for the full term.

The reason for the popularity of floating interest rates is their low rates; it is not unusual to find rates below 0.5%.

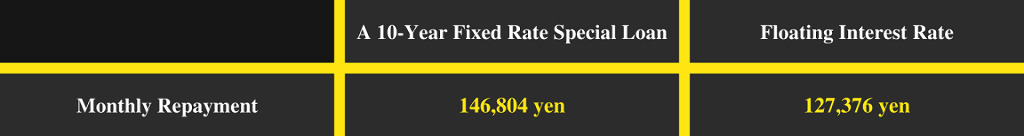

For example, SMBC Trust Bank PRESTIA’s floating interest rate is 0.39% per year. If you borrow 50 million yen with a repayment period of 35 years (equal principal and interest, no bonus repayment), compared to a 10-year fixed-rate special loan (interest rate: 1.24%), the difference in monthly repayment is as follows:

The lack of significant changes in floating interest rates may be one of the reasons why they are chosen more often. According to data published by the Japan Housing Finance Agency, floating interest rates have not changed over the past 20 years. Under this circumstance, floating interest rates might be suitable for you to keep your initial repayment as low as possible, even though you have a risk of your repayment amount increasing, if the applicable interest rate rises significantly in the future.

5. What Is SMBC Trust Bank PRESTIA’s Floating Interest Rate?

SMBC Trust Bank PRESTIA is one of the popular banks in Japan and offers some types of mortgages to foreigners.

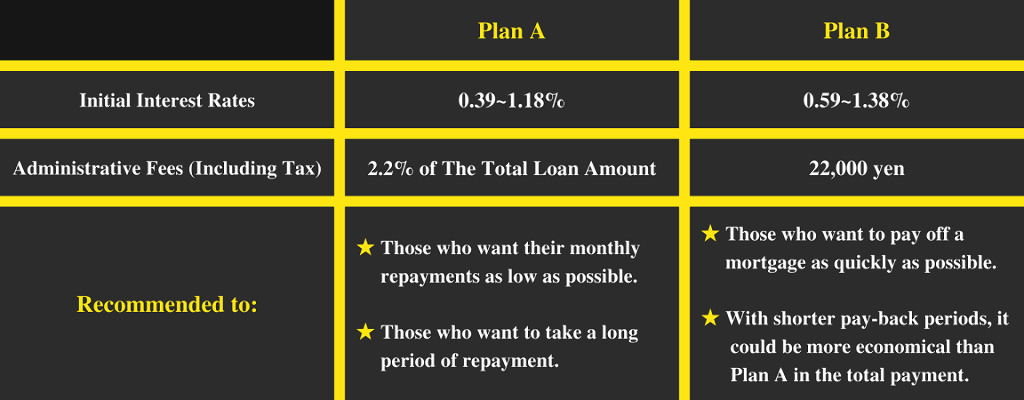

There are two types of floating interest rates offered by SMBC Trust Bank PRESTIA: A Plan and B Plan.

Both are a type of one-year review, and the base interest rate is 2.63% per year.

*For more details, please contact SMBC Trust Bank PRESTIA.

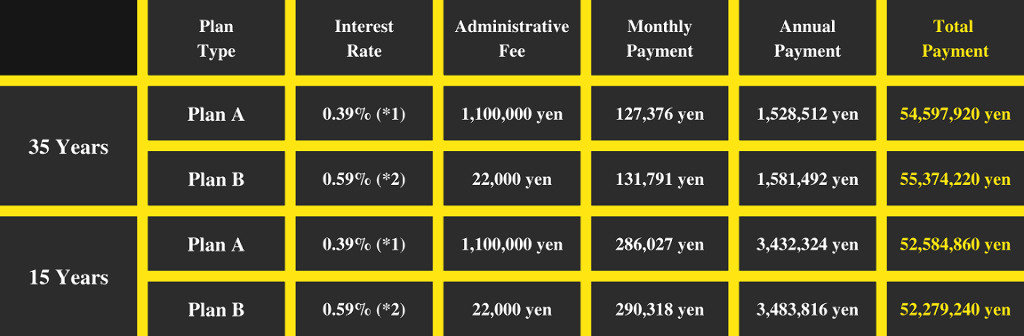

Example: Simulation for repayment of A Plan & B Plan

◉ The total amount of borrowing amount is 50,000,000 yen

◉ The pay-back period is 35 years vs. 20 years

*1: A Plan: The interest rate of 0.39% is available when borrowing a Housing loan of 50 million Yen or more. The basic interest rate of the A Plan is 1.18% (as of Mar. 2023).

*2: B Plan: The interest rate of 0.59% is available when borrowing a Housing loan of 50 million Yen or more. The basic interest rate of the B Plan is 1.38% (as of Mar. 2023).

Conclusion

This article described fixed and floating interest rates on mortgages.

In Japan, floating interest rates tend to be chosen more often. If the characteristics of floating interest rates match your situation, you may want to consider a mortgage loan on the assumption that you will use floating interest rates.

Each financial institution offers different services for floating-rate mortgages. If you are not sure which service to choose, we recommend that you consult with a specialist.